The two largest state-owned banks of China have stopped transactions on commodities in Russia.

In China, the two largest state banks have stopped servicing transactions for the purchase of raw materials in Russia.

Bloomberg writes about this, referring to a source familiar with the situation.

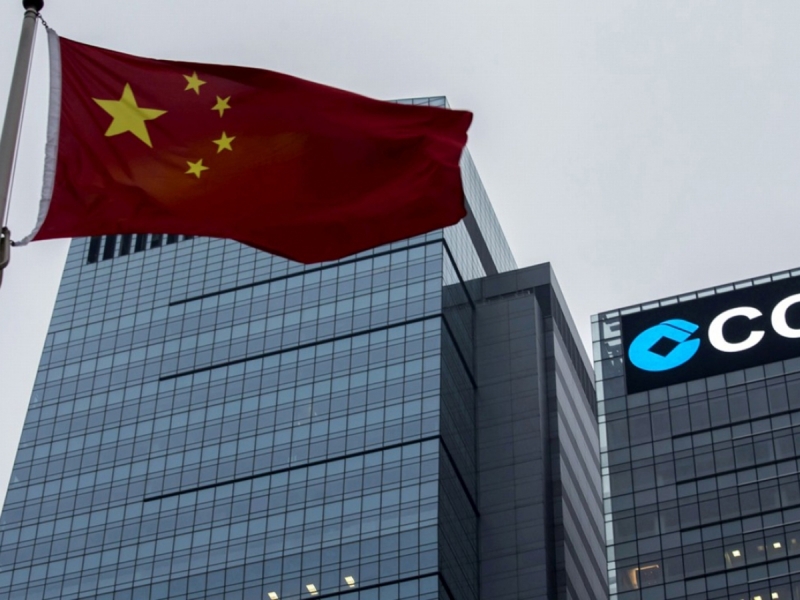

Following the Western banks, the divisions of the Chinese ICBC offshore stopped issuing letters of credit to cover transactions with commodity exporters of the Russian Federation.

The financial institution has stopped servicing deliveries in dollars, but in some cases issues letters of credit for transactions in yuan, and for each such decision it is necessary to obtain management approval.

Bank of China has limited financing for purchases of raw materials in the Russian Federation. This decision was made by the bank’s risk management.

Now the credit institution is awaiting the recommendations of the national regulator.

Before that, China’s largest banks adhered to sanctions against Iran, North Korea, as well as Hong Kong officials for fear of falling under the measures of the US Treasury.

According to experts, Chinese banks take sanctions decisions seriously, as they do not want to lose access to transactions in dollars.

Recall that last Thursday, Western banks began to refuse to issue letters of credit for oil supplies from Russia. As a result, the price of the Russian Urals variety has fallen record-breaking to other brands – now a barrel is 11.25 dollars cheaper than Brent, and the demand for spot lots of Urals has collapsed to zero.

Earlier, topNews wrote that the US, the EU and the UK will put Putin and Lavrov on the sanctions list.

Their assets in these countries will be frozen.